Applicable Large Employer Worksheet

The affordable care act makes it a shared responsibility of individuals employers and government to ensure that as many people as possible have health insurance. Additional rules and exceptions may apply in specific circumstances.

Appendix a applicable large employer ale worksheet instructions the ale worksheet provides a tool with which to determine and document your aca reporting statusit is easy to use and requires you to perform some basic calculations as described below.

Applicable large employer worksheet. This worksheet is intended for general information only and is not to be construed as legal advice. Basic ale determination examples. Below are some examples of calculations for companies that are or are not considered applicable large employers under irs rules.

Less than 50 employees. The law does not require all us. If an employer is part of a group for which employer aggregation rules apply under internal revenue code 414b c m and o this calculation must be made for all entities in the group with the totals combined to determine whether the group is an applicable large employer.

Employers to offer health insurance to their workers. The worksheet provides a basic overview of the applicable large employer calculation. An applicable large employer is an employer that employs an average of 50 or more full time and full time equivalent employees during the preceding calendar year.

For employers that are an applicable large employer an estimate of the maximum amount of the potential liability for the employer shared responsibility payment that could apply based on the number of full time employees reported if an employer fails to offer coverage to its full time employees. This worksheet is intended for genera information only and is not to be construed as legal advice the worksheet provides a basic ovenew of the appcable large employer calcuafion. In addition self insured ales that is employers who sponsor self.

The employer shared responsibility provision and the employer information reporting provision for offers of minimum essential coverage. Applicable large employer worksheet. And the employees in excess of 50 during this penod of time are seasonal employees then the employer is not an applicable large em ployer.

The following worksheet provides the basic calculation for determining whether or not an employer is an applicable large employer. Two provisions of the affordable care act apply only to applicable large employers ales. The employer mandate and penalty has been delayed to 2016 for employers with 50 99 fte employees.

Rather only employers defined by federal regulations as applicable large employers or ales must make insurance available or pay a penalty. Its important to calculate hours to determine whether a company is considered an applicable large employer under irs rules and thus subject to the employer mandate. It is important for your business to understand whether you are defined as an applicable large employer by the irs as the mandate and employer tax penalties only apply to your business if you are an applicable large employer.

2018 Withholding Updates H R Block

2018 Withholding Updates H R Block

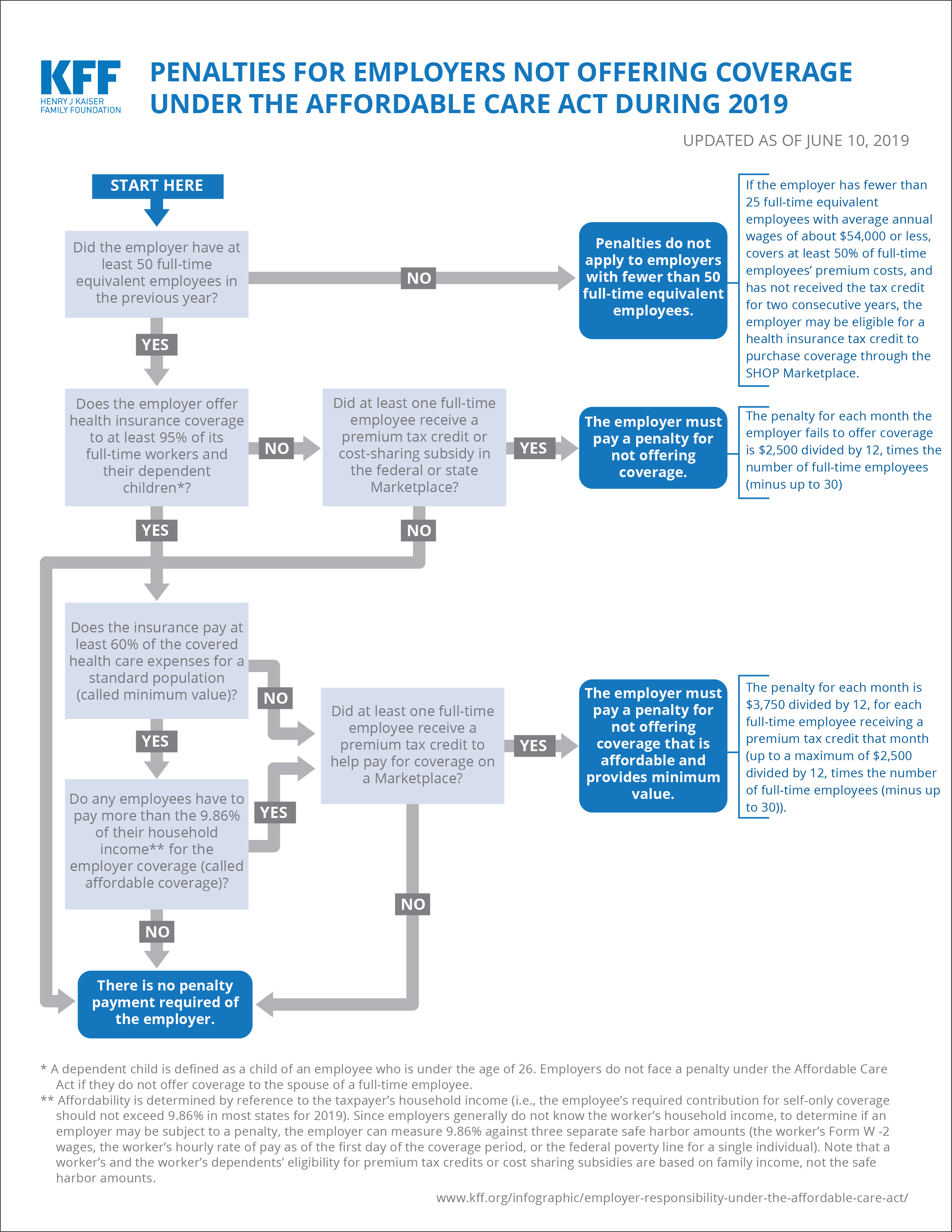

Employer Responsibility Under The Affordable Care Act The Henry J

Employer Responsibility Under The Affordable Care Act The Henry J

What Individuals Need To Know About The Affordable Care Act For 2016

Aca Best Practices Annual Healthcare Reporting Strategic Employee

The Hr And Payroll Guide To Name Changes

The Hr And Payroll Guide To Name Changes

2018 Aca Reporting Your Questions Answered

2018 Aca Reporting Your Questions Answered

Payville Usa Affordable Care Act

W 4 Forms For New Hires New Hire Forms

W 4 Forms For New Hires New Hire Forms

How To Fill Out A Form W 4 For 2019 Millennial Money

How To Fill Out A Form W 4 For 2019 Millennial Money

Mckay Tax Accounting Blog Integrity Needs No Rules

Mckay Tax Accounting Blog Integrity Needs No Rules

Publication 974 2018 Premium Tax Credit Ptc Internal Revenue

Publication 974 2018 Premium Tax Credit Ptc Internal Revenue

1095 C Reporting Requirements A Step By Step Guide

1095 C Reporting Requirements A Step By Step Guide

Tax Calendar Fenner Melstrom Dooling Plc

Tax Calendar Fenner Melstrom Dooling Plc

Tax Due Dates Abruzzo Accounting Llc

Aca Affordability Percentage Increases To 9 86 For 2019

Aca Affordability Percentage Increases To 9 86 For 2019

/w42018.cropped-5bfc2e8e46e0fb00265c78e6.jpg) W 4 Form How To Fill Out A W 4 Form Investopedia

W 4 Form How To Fill Out A W 4 Form Investopedia

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy

Complete Guide To 2019 Aca Affordability Percentages Penalties For

Complete Guide To 2019 Aca Affordability Percentages Penalties For

Commonwealth Of Massachusetts 1095 C Frequently Asked Questions

Employer Benefit Adviser Newsletter Allied National

Vita Tce Basic Certification Topics On Affordable Care Act

Employee Benefits Compliance Checklist For Large Employers

Sage 100 Payroll Year End Webinar 2018

Sage 100 Payroll Year End Webinar 2018

3613 Worksheet A 8 Adjustments To Expenses

Obamacare Healthcare Reporting Are You Prepared

Obamacare Healthcare Reporting Are You Prepared

Sharpen Your Skills Adp Reporting

The Affordable Care Act Foundation Accounting Software

The Affordable Care Act Foundation Accounting Software

March 2018 Johnson Block Cpas Madison Wi

March 2018 Johnson Block Cpas Madison Wi

0 Response to "Applicable Large Employer Worksheet"

Post a Comment