Qualified Dividends And Capital Gain Tax Worksheet Calculator

Qualified dividends and capital gain tax worksheet form 1040 instructions page 40. Qualified dividends and capital gain tax worksheet form 1040 instructions html.

Qualified Dividends And Capital Gain Tax Worksheet Holidayfu Com

Click forms in the upper right upper left for mac and look through the forms in my return list and open the qualified dividends and capital gain tax worksheet.

Qualified dividends and capital gain tax worksheet calculator. The 27 lines because they are so simplified end up being difficult to follow what exactly they do. See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. In filing my own taxes the most difficult part to calculate has always been the qualified dividends and capital gain tax worksheet.

For the desktop version you can switch to forms mode and open the worksheet to see it. 2018 qualified dividends and capital gain tax worksheet. The worksheet generally matches a large portion of the irs form 1040 schedule d including for claritys sake the schedule d line numbering.

And i work for tax foundation. Capital gains tax calculation worksheet this display only worksheet shows the capital gains calculation. Instead 1040 line 44 tax asks you to see instructions in those instructions there is a 27 line worksheet called the qualified dividends and capital gain tax worksheet which is how you actually calculate your line 44 tax.

Before completing this worksheet complete form 1040 through line 43. I have in fact even checked the programming of this. The tax summary screen will then indicate if the tax has been computed on the schedule d worksheet or the qualified dividends and capital gain tax worksheet.

If you do not have to file schedule d and you received capital gain distributions be sure you checked the box on line 13 of form 1040. To review the tax summary in the taxact program click on federal refund or federal owed amount in the top right corner of the screen. Report your qualified dividends on line 9b of form 1040 or 1040a.

The tax calculation did not work correctly with the new tcja regular tax rates and brackets for certain taxpayers who had 28 rate gain taxed at a maximum rate of 28 or unrecaptured section 1250 gain taxed at a maximum rate of 25. I often have to do it several times in order to make sure i did not mess it up. The line 44 worksheet is also called the qualified dividends and capital gain tax worksheet.

1 dont churn your portfolio you want to pay the long term capital gains rate and pay that as infrequently as possible. Many index funds are low churn and tax efficient 2 open a retirement account a deductible ira gives you a negative adjustment lowering your taxable incomea roth ira gives you a tax break later 3 have good debt. The resulting net capital gain tax amount shown at line 37 is carried to the summary.

Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a to figure your total tax amount.

The Go Curry Cracker 2016 Taxes Go Curry Cracker

The Go Curry Cracker 2016 Taxes Go Curry Cracker

Tx303 Intermediate Income Taxes

Tx303 Intermediate Income Taxes

Qualified Dividends And Capital Gains Worksheet Calculator

Qualified Dividends And Capital Gains Worksheet Calculator

2015 2019 Form Irs Instruction 1040 Line 44 Fill Online Printable

2015 2019 Form Irs Instruction 1040 Line 44 Fill Online Printable

And 2018 Worksheet Qualified Dividends Gains Capital

And 2018 Worksheet Qualified Dividends Gains Capital

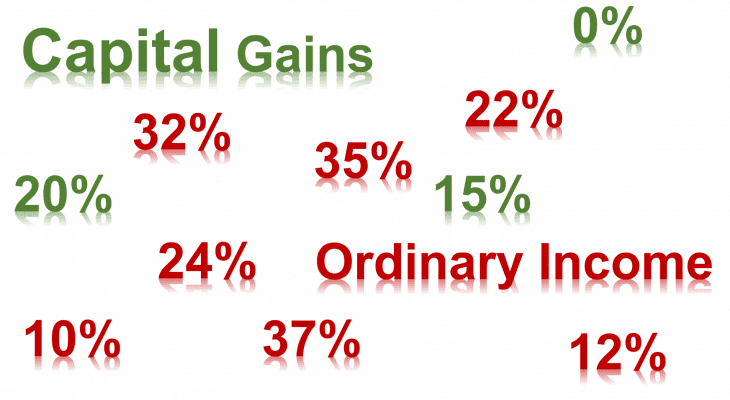

Capital Gains Tax Brackets 2019 What They Are And Rates

Capital Gains Tax Brackets 2019 What They Are And Rates

Qualified Dividends And Capital Gain Tax Worksheet Line 44 Fresh

Qualified Dividends And Capital Gain Tax Worksheet Line 44 Fresh

12 Brilliant Qualified Dividends And Capital Gain Tax Worksheet

12 Brilliant Qualified Dividends And Capital Gain Tax Worksheet

![]() Thanksgiving Subtraction Worksheets With Regrouping The Digit Minus

Thanksgiving Subtraction Worksheets With Regrouping The Digit Minus

How To Figure The Qualified Dividends On A Tax Return Finance Zacks

How To Figure The Qualified Dividends On A Tax Return Finance Zacks

/486989097-56a938ab3df78cf772a4e54c.jpg) 2019 Tax Tips For Capital Gains And Losses

2019 Tax Tips For Capital Gains And Losses

Capital Gains Tax Worksheet 2014 Capital Gain Loss Transactions

Partnership Basis Worksheet Qualified Dividends And Capital Gain Tax

Qualified Dividends And Capital Gain Tax Worksheet Line 44 24 New

Qualified Dividends And Capital Gain Tax Worksheet Line 44 24 New

Qualified Dividends And Capital Gains Worksheet Calculator

Qualified Dividends And Capital Gains Worksheet Calculator

Tax Advantages Add Appeal To Qualified Dividends Dividendinvestor Com

Tax Advantages Add Appeal To Qualified Dividends Dividendinvestor Com

Printable Qualified Dividends And Capital Gain Tax Worksheet 2017

Printable Qualified Dividends And Capital Gain Tax Worksheet 2017

Tx303 Intermediate Income Taxes

Tx303 Intermediate Income Taxes

Income Tax Guide For 2018 The Simple Dollar

Income Tax Guide For 2018 The Simple Dollar

Qualified Dividends And Capital Gain Tax Worksheet 1040a

Qualified Dividends And Capital Gain Tax Worksheet 1040a

Irs Qualified Dividends And Capital Gain Tax Worksheet

Irs Qualified Dividends And Capital Gain Tax Worksheet

Qualified Dividends And Capital Gain Tax Ivoiregion

Qualified Dividends And Capital Gain Tax Ivoiregion

:brightness(10):contrast(5):no_upscale()/172166555-F-56a938a73df78cf772a4e533.jpg) Calculate Capital Gains When Selling Fund Shares

Calculate Capital Gains When Selling Fund Shares

Math Form 1041 Schedule D Capital Gains And Losses Tax2011irs With

2019 Capital Gains Tax Rates And How To Avoid A Big Bill Nerdwallet

2019 Capital Gains Tax Rates And How To Avoid A Big Bill Nerdwallet

Qualified Dividends And Capital Gain Tax Worksheet Review Of What Is

25 Best Of Qualified Dividends And Capital Gain Tax Worksheet 2016

Partnership Basis Worksheet Qualified Dividends And Capital Gain Tax

0 Response to "Qualified Dividends And Capital Gain Tax Worksheet Calculator"

Post a Comment