Car And Truck Expenses Worksheet

In your farm business. See the possible fixes below.

The Best Car Truck Expenses Worksheet Schedule C Exterior And

The Best Car Truck Expenses Worksheet Schedule C Exterior And

Car truck expenses worksheet information submitted by vehicle 1 vehicle 2 vehicle 3 make model of vehicle date placed in business use if truck please list 12 34 or 1 ton odometer reading as of 12 31 17 odometer reading as of 01 01 17 total miles for the year business miles for the year.

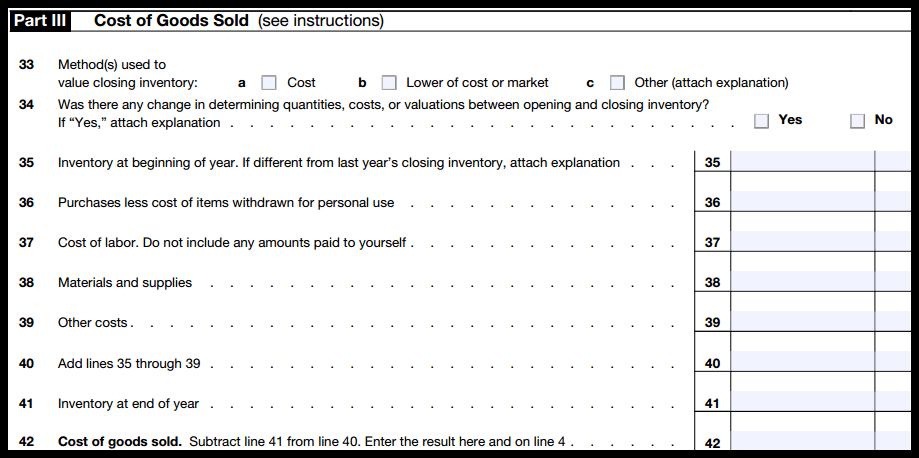

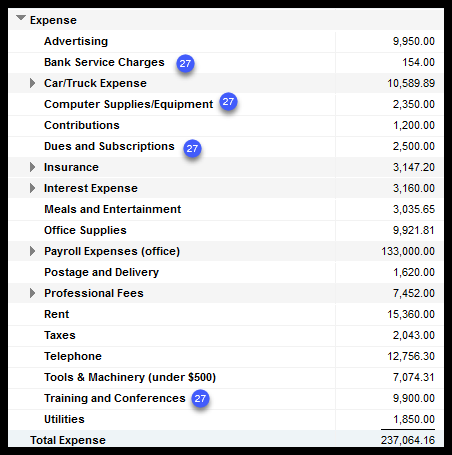

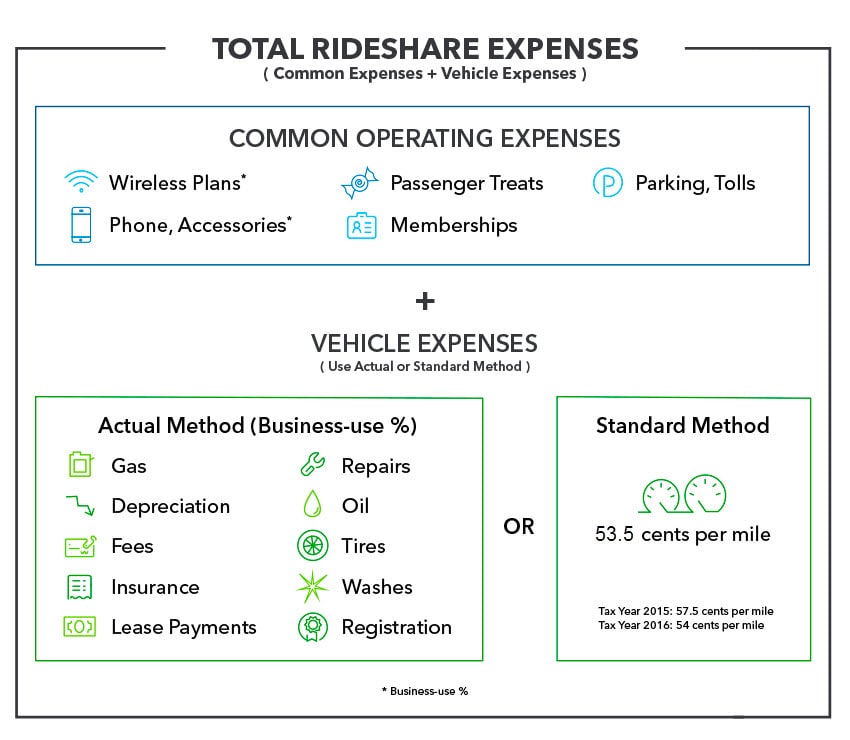

Car and truck expenses worksheet. The record keeping requirements are the same no matter what type of tax deductible car and truck expenses you claim. There are several different types of tax deductible car and truck expenses that individuals and business taxpayers are eligible to deduct on their return. Also use schedule c to report a wages and expenses you had as a statutory employee b income and deductions of certain qualified joint ventures and c certain income shown on form 1099 misc miscellaneous income.

Some of the worksheets displayed are vehicle expense work vehicle expense work truckers work on what you can deduct 2017 tax year car and truck expense work truckers income expense work schedule c business work car and truck expenses work complete for all vehicles over the road trucker expenses list. Comments about tax map. Car and truck expenses.

To report income from a nonbusiness activity see the instructions for schedule 1 form 1040 line 21 or form 1040nr line 21. Publication 334 tax guide for small business for individuals who use schedule c or c ez car and truck expenses. Standard mileage ratepersonal property taxes.

If you did answer yes. Schedule c part ii expenses line 9 car and truck expenses is including the property tax entered on line 25b of the cartruck worksheet and i am claiming the standard mileage rate. Sch c wks car amp.

Car and truck expenses. Car and truck expenses. You have two options for deducting car and truck expenses.

Showing top 8 worksheets in the category car and truck expenses. Car and truck expense worksheet general info vehicle 1 vehicle 2 must have to claim standard mileage rate dates used if not for the time period description of vehicle date placed in service total business miles total commuting miles other miles total miles for the period purchased or leased vehicle information. If you use your car or truck in your business you can deduct the.

Amt dep allowedallowable 1 is too large. If you have any other details regarding this question please feel free to post them in the comment section. You can use your actual expenses which include parking fees and tolls interest on a vehicle loan vehicle registration fees personal property tax on the vehicle lease and rental expenses insurance fuel and gasoline repairs including oil changes tires and other routine.

Truck expenses worksheet less than 5 at a time this question is asking whether you used less than 5 vehicles or more than 5 vehicles for your schedule c business.

:max_bytes(150000):strip_icc()/TipsforDeductingTravelExpensesonTaxes-Westend61-GettyImages-5a70c75fae9ab80037b8beee.jpg) Rules For Deducting Car And Truck Expenses On Taxes

Rules For Deducting Car And Truck Expenses On Taxes

Schedule C Car And Truck Expenses Worksheet Unique Intended For

Schedule C Car And Truck Expenses Worksheet Unique Intended For

Truck Driver Expenses Worksheet Awesome Truck Drivers Trip Sheet

Truck Driver Expenses Worksheet Awesome Truck Drivers Trip Sheet

Schedule C Car And Truck Expenses Worksheet Best Of Farm Expense

Schedule C Car And Truck Expenses Worksheet Best Of Farm Expense

Truck Driver Tax Deductions Worksheet Schedule C Car And Truck

Truck Driver Tax Deductions Worksheet Schedule C Car And Truck

Income And Expense Worksheet Template Sample Sheet Templates Business

Figuring Cost Per Mile Owner Operator Independent Drivers Association

Figuring Cost Per Mile Owner Operator Independent Drivers Association

Schedule C Car And Truck Expenses Worksheet Luxury Tax Spreadsheet

The Best Car Truck Expenses Worksheet Exterior And Interior

The Best Car Truck Expenses Worksheet Exterior And Interior

Irs Schedule C Instructions Step By Step Including C Ez

Irs Schedule C Instructions Step By Step Including C Ez

Schedule C Expenses Worksheet Home Design Ideas Home Design Ideas

Truck Driver Expenses Worksheet Unique Trucker Expense Spreadsheet

Truck Driver Expenses Worksheet Unique Trucker Expense Spreadsheet

Used Car Dealer Accounting Spreadsheet Or Spreadsheets Used In

Used Car Dealer Accounting Spreadsheet Or Spreadsheets Used In

Irs Schedule C Instructions Step By Step Including C Ez

Irs Schedule C Instructions Step By Step Including C Ez

Schedule C Expenses Worksheet Beautiful Schedule C Expenses

Schedule C Expenses Worksheet Beautiful Schedule C Expenses

Genworth Case Study Completing The Form 91 With Personal Tax Returns

Genworth Case Study Completing The Form 91 With Personal Tax Returns

Beauty Barber Industry Income Expense Worksheet Form Fill Out

Beauty Barber Industry Income Expense Worksheet Form Fill Out

Maximizing Tax Deductions For The Business Use Of Your Car

Maximizing Tax Deductions For The Business Use Of Your Car

Farm Expenses Spreadsheet Regular Farm Accounting Spreadsheet Free

Farm Expenses Spreadsheet Regular Farm Accounting Spreadsheet Free

Spreadsheet For Expenses And Income For 30 Unique Car And Truck

27 Awesome Living Expenses Worksheet Incharlottesville Com

The 7 Best Expense Report Templates For Microsoft Excel Teampay

The 7 Best Expense Report Templates For Microsoft Excel Teampay

Top Car Truck Expenses Worksheet Concept Truck Reviews News

Top Car Truck Expenses Worksheet Concept Truck Reviews News

Schedule C Expenses Spreadsheet Or Schedule C Car And Truck Expenses

0 Response to "Car And Truck Expenses Worksheet"

Post a Comment