Shareholder Basis Worksheet Excel

A shareholder has a stock basis and a debt basis. If a portion of the shareholders stock is disposed of enter the stock basis related to the shares sold after considering the current years adjustments eg income expense and distribution items.

The Warren Buffett Spreadsheet A Powerful Value Investing Excel

The Warren Buffett Spreadsheet A Powerful Value Investing Excel

To move to the basis wks screen for another person or entity open that persons or entitys k1 screen and click the basis worksheet tabs there.

Shareholder basis worksheet excel. See open account debt page 19 11 thetaxbook deluxe editionsmall business edition. The amount that the propertys owner has invested into the property is considered the basis. The top of the basis worksheet and basis worksheet continued screen displays the id number and name of the person or entity to which the worksheet refers.

For losses and deductions which exceed a shareholders stock basis the shareholder is allowed to deduct the excess up to the shareholders basis in loans personally made to the s corporation see item 4 below. This worksheet assumes loans from the shareholder are combined and not evidenced by separate written instruments. The initial debt basis is the amount of money loaned by the shareholder to the s corporation.

Decreased for items of loss and deduction. When determining the taxability of a non dividend distribution the shareholder looks solely to his stock basis. This amount entered on line 20 is the shareholders stock basis for calculating gain or loss on the stock disposition.

Each block of stock is accounted for separately. You do need to prepare a worksheet like the one linked above for each prior year of your ownership in order to get to your current basis. Increased for income items and excess depletion.

Stock basis is adjusted annually as of the last day of the s corporation year in the following order. An s corp basis worksheet is used to compute a shareholders basis in an s corporation. There are separate worksheets for stock and debt basis.

S corporation shareholder stock basis worksheet. Shareholders who have ownership in an s corporation must make a point to have a general understanding of basis. The initial stock basis is the amount of equity capital supplied by the shareholder.

Stock basis is also adjusted when shareholders buy sell or transfer shares. Decreased for non deductible non capital expenses and depletion. Losses from s corporations are deductible on a taxpayers form 1040 only to the extent of the shareholders stock plus debt basis.

This basis fluctuates with changes in the company. Tax preparers should maintain the following two worksheets courtesy small business taxes and management for each of their s corporation shareholder clients. I hope this helps for computing your basis in the s corporation.

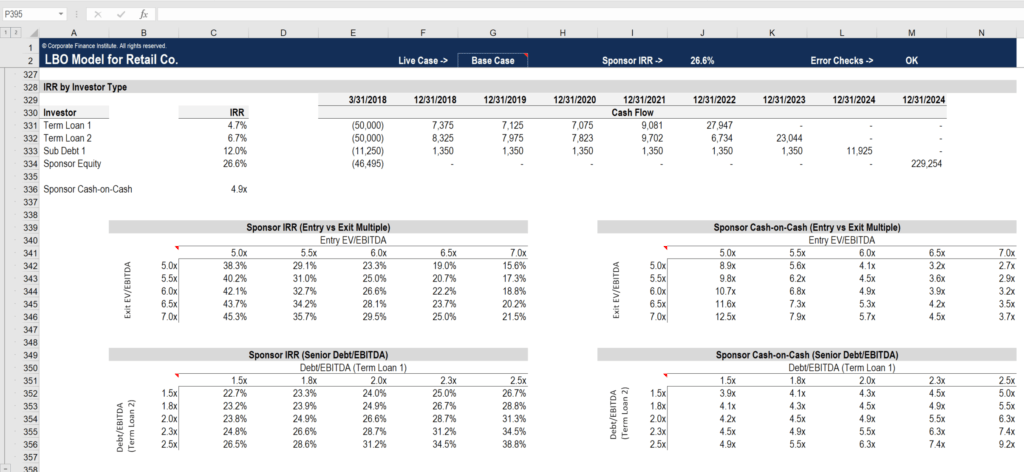

Financial Model Templates Download Over 200 Free Excel Templates

Financial Model Templates Download Over 200 Free Excel Templates

S Corporation Basis Worksheet Oaklandeffect

S Corporation Basis Distributions

Does An S Corporation S Credit Card Debt Increase Shareholders

Does An S Corporation S Credit Card Debt Increase Shareholders

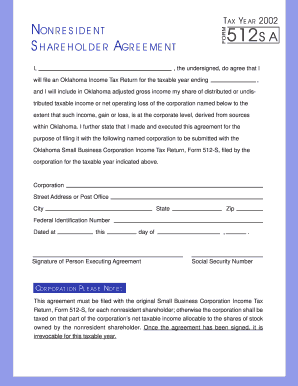

18 Printable Shareholders Agreement Sample In Word Format Templates

18 Printable Shareholders Agreement Sample In Word Format Templates

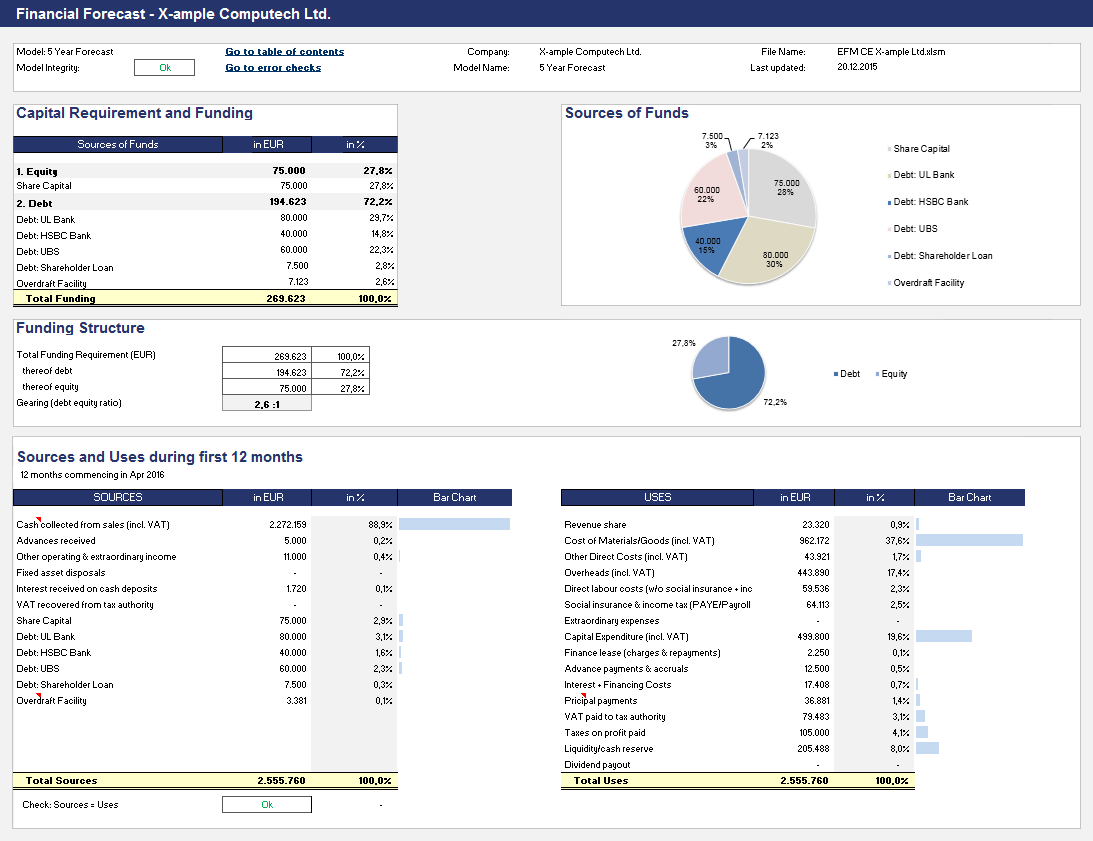

Excel Financial Model For Classic Economy

Excel Financial Model For Classic Economy

Gilti Detailed Calculation Example

Gilti Detailed Calculation Example

Assets And Liabilities Template Excel Spreadsheet Personal Statement

S Corporation Basis Distributions

Balance Sheet Template Simple Basic Accounting Example Worksheet

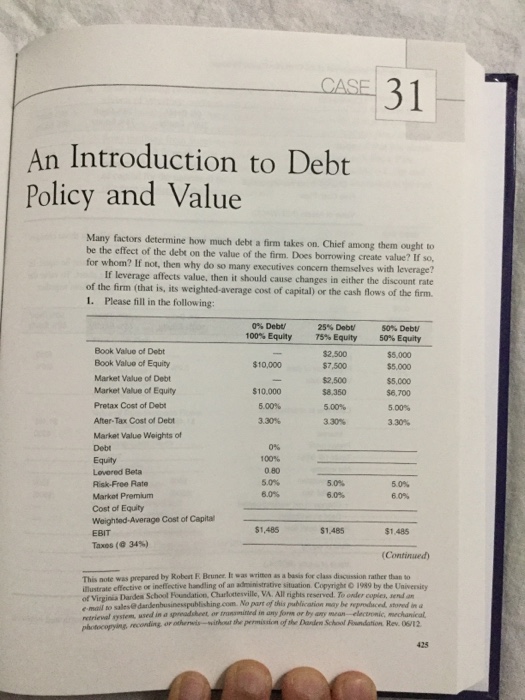

Financial Modeling Asimplemodel Com

Financial Modeling Asimplemodel Com

Partnership Basis Worksheet Qualified Dividends And Capital Gain Tax

Taxes And Mutual Funds 3 Christianledesma

Shareholder Basis Worksheet Karenlynndixon Info

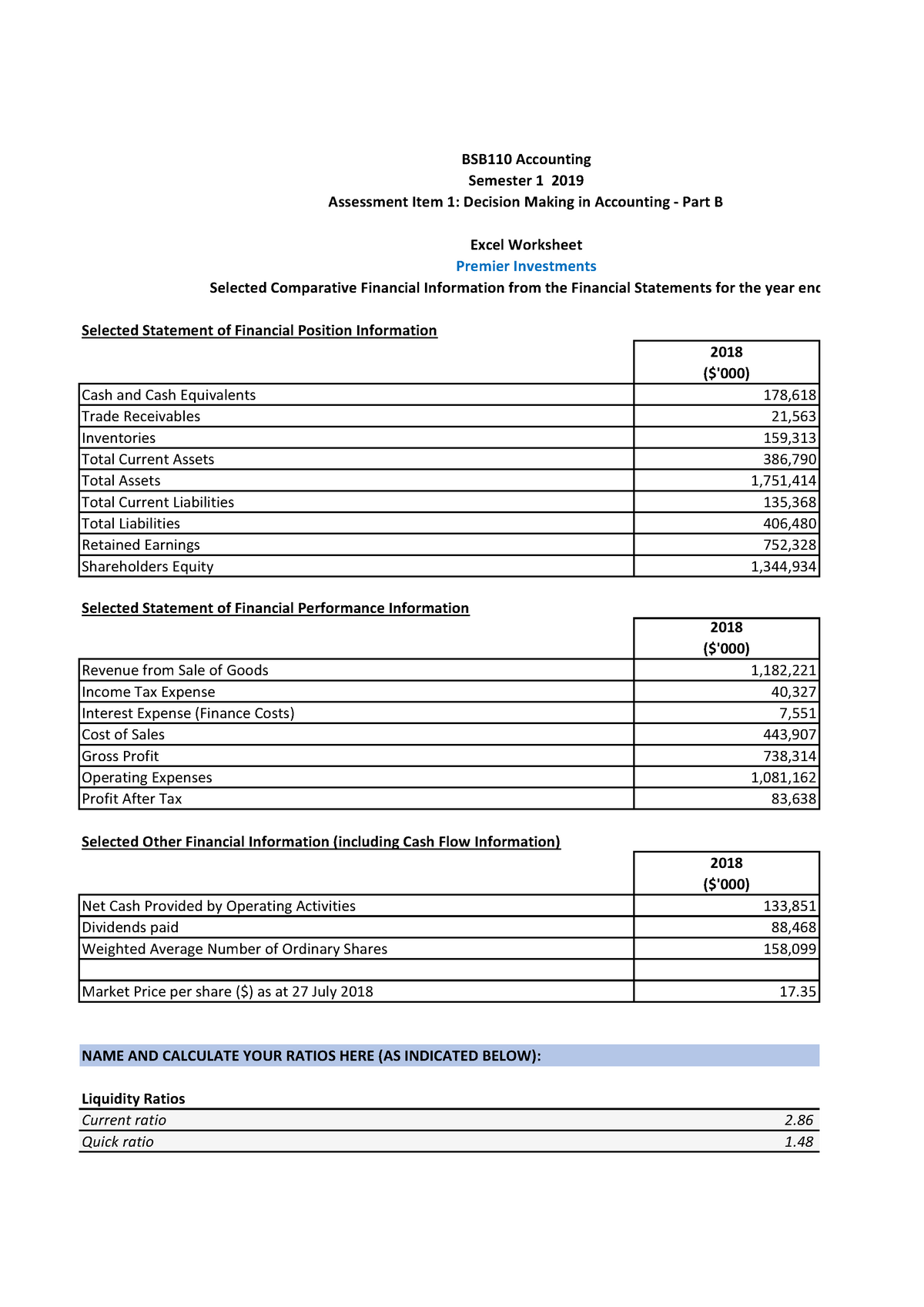

Part B Part B Of The Assignment 8 10 Bsb110 Accounting Studocu

Part B Part B Of The Assignment 8 10 Bsb110 Accounting Studocu

![]() Line Of Credit Tracker For Excel

Line Of Credit Tracker For Excel

S Corporation Shareholder Basis

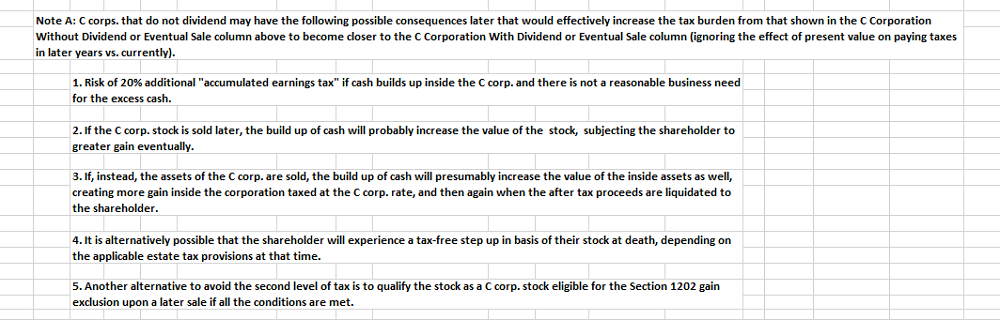

Update On The Qualified Business Income Deduction For Individuals

Update On The Qualified Business Income Deduction For Individuals

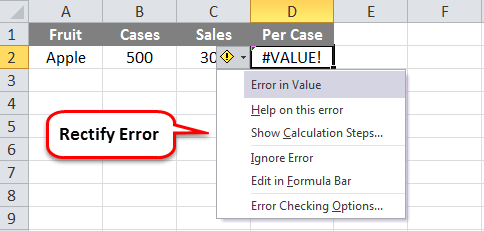

Top 10 Basic Excel Formulas Useful For Any Professionals

Top 10 Basic Excel Formulas Useful For Any Professionals

Gilti Detailed Calculation Example

Gilti Detailed Calculation Example

Publicly Traded Partnerships Tax Treatment Of Investors

50 Google Sheets Add Ons To Supercharge Your Spreadsheets The

50 Google Sheets Add Ons To Supercharge Your Spreadsheets The

Spreadsheet Risks Still Being Ignored By C Suite Study Cfo

Spreadsheet Risks Still Being Ignored By C Suite Study Cfo

Labour Cost Calculation Excel Template Eloquens

Labour Cost Calculation Excel Template Eloquens

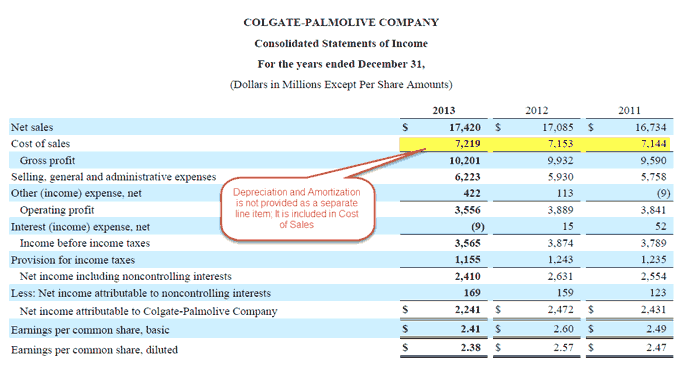

Financial Modeling In Excel Free Training Colgate Example

Financial Modeling In Excel Free Training Colgate Example

Shareholder Basis Worksheet Karenlynndixon Info

0 Response to "Shareholder Basis Worksheet Excel"

Post a Comment