Sale Of Rental Property Worksheet

Sale price 6 less adjusted basis line 5 above 7 capital gain lines 6 minus 7 8 type of capital gain 25 rate gain line 4 above 9 15 rate gain lines 8 minus 9 10 total capital gain lines 9 10 11. Real property used in your trade or business.

How To Calculate Roi On A Rental Property To Find Great Investments

How To Calculate Roi On A Rental Property To Find Great Investments

The irs has one more surprise for rental property owners.

Sale of rental property worksheet. Assuming you sold a property for 200k and you paid 6 commission 12k plus other closing costs that added to 6k your selling costs are 18k selling costs 12k commission 6k closing costs 2. If you sell it for more than the value after subtracting all of your depreciation youll have to pay a special 25 percent section 1250 depreciation recapture tax on the depreciation you claimed. Accounting for sale price.

Personal use of rental property. Publication 17 your federal income tax for individuals sale of property. Report the sale of the rental property on schedule d of form 1040 in the year you sell the property.

Report mileage expense on the vehicle expense and mileage worksheet see fancy button above. Your gain from the sale or trade of property to a related party. These expenses are generally about 5 10 business use per rental.

If you sell the property for 500000 and had an adjusted basis of 350000 you have 150000 in capital gains. Second you calculate the adjusted cost basis of your property. When you sell your property you will report all financial details related to the sale in schedule d of the 1040 tax return form.

Once you have sold your rental property you must subtract the adjusted basis from the selling price to determine what gains will be taxed under the capital gains tax rate. Subtract the resulting adjusted basis from the selling price of the property. While you owned your rental property you were entitled to depreciate the building and any improvements.

The sale or exchange of. Oil gas geothermal or other mineral properties. Calculating gain on sale of rental property.

Depreciable and amortizable tangible property used in your trade or business however see disposition of depreciable property not used in trade or business later. Gain on sale or trade of depreciable property. Cell phone and internet expenses are for managing the property calling tenants performing background checks coordinating with contractors etc.

If you sometimes use your rental property for personal purposes you must divide your expenses be tween rental and personal use. If you later sell or dispose of property changed to business or rental use the basis you. In most cases the expenses of renting your property such as maintenance insurance taxes and interest can be deducted from your rental income.

Schedule E Disposition Of Rental Property Schedulee

How To Calculate Taxable Income On Rental Properties 10 Steps

How To Calculate Taxable Income On Rental Properties 10 Steps

What Are The Tax Implications Of Selling A Rental Property

What Are The Tax Implications Of Selling A Rental Property

How To Prevent A Tax Hit When Selling A Rental Property

How To Prevent A Tax Hit When Selling A Rental Property

Investment Property Calculator Excel Spreadsheet Condo Analysis

How To Figure Capital Gains On The Sale Of Rental Property Pocketsense

How To Figure Capital Gains On The Sale Of Rental Property Pocketsense

St Johns Az Accounting Firm Sale Of Property Worksheet Page

Quiz Worksheet Comparable Sales Approach In Real Estate Study Com

Quiz Worksheet Comparable Sales Approach In Real Estate Study Com

Tips For Landlords On Calculating Gain On Sale Of Rental Property

Tips For Landlords On Calculating Gain On Sale Of Rental Property

Publication 527 2018 Residential Rental Property Internal

Publication 527 2018 Residential Rental Property Internal

Tax Organizers Guides Taxation For Real Estate Investors

Renting Vs Buying Detailed Analysis Video Khan Academy

Renting Vs Buying Detailed Analysis Video Khan Academy

17 Property Inventory Templates Word Pdf Excel Free Premium

17 Property Inventory Templates Word Pdf Excel Free Premium

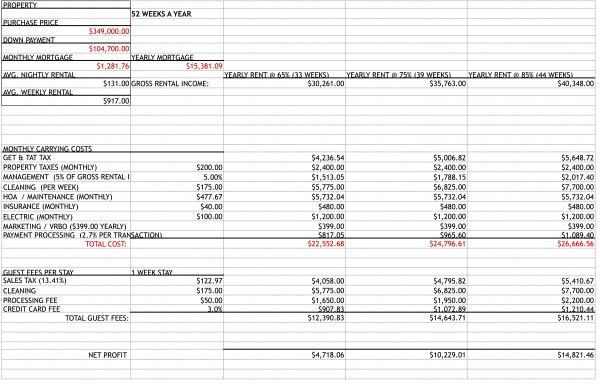

Toolkit For Purchasing Hawaii Vacation Rental Property

Toolkit For Purchasing Hawaii Vacation Rental Property

10 Free Real Estate Spreadsheets Real Estate Finance

Using An Excel Decision Tree To Decide Whether To Sell Or Keep A

Rental Property Tax Deductions Worksheet Accounting Spreadsheet C

Rental Property Tax Deductions Worksheet Accounting Spreadsheet C

Should You Invest In This Rental Income Property

Should You Invest In This Rental Income Property

Fannie Mae 1037pdffillercom Fill Online Printable Fillable

Fannie Mae 1037pdffillercom Fill Online Printable Fillable

Vacation Rentals By Owner Expenses Spreadsheet Rental Income

Vacation Rentals By Owner Expenses Spreadsheet Rental Income

Cash Flow Analysis Worksheet For Rental Property

Cash Flow Analysis Worksheet For Rental Property

Capital Gains Tax On Rental Property Sale

Capital Gains Tax On Rental Property Sale

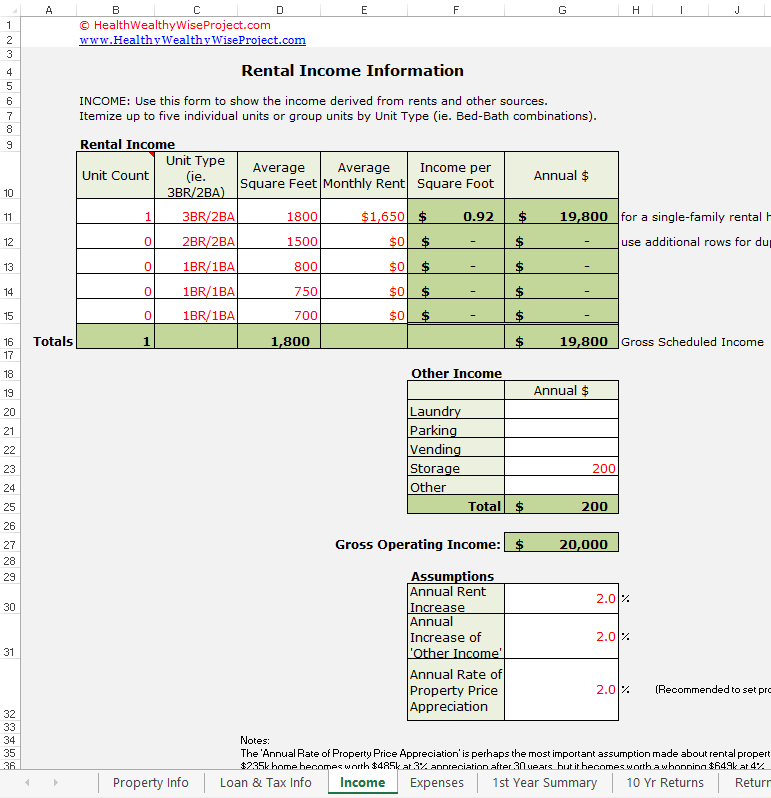

Rental Income Property Analysis Excel Spreadsheet

Rental Income Property Analysis Excel Spreadsheet

Rental Property Deduction Checklist 20 Tax Deductions For Landlords

Rental Property Deduction Checklist 20 Tax Deductions For Landlords

Rental Property Cashflow Analysis Safe Income Usa

Rental Property Cashflow Analysis Safe Income Usa

2019 Business Tax Renewal Instructions Los Angeles Office Of Finance

2019 Business Tax Renewal Instructions Los Angeles Office Of Finance

10 Free Real Estate Spreadsheets Real Estate Finance

0 Response to "Sale Of Rental Property Worksheet"

Post a Comment