Ira Deduction Worksheet 2014

Ira deduction if you are not covered by a retirement plan at work 2018 deduction is limited only if your spouse is covered by a retirement plan see publication 590 a contributions to individual retirement arrangements iras for additional information including how to report your ira contributions on your individual federal income tax. A full deduction up to the amount of your contribution limit.

30 Beautiful Itemized Deductions Worksheet For Small Business

Individual retirement arrangement ira ira deduction worksheet.

Ira deduction worksheet 2014. Examples worksheet for reduced ira deduction for 2014. The following examples illustrate the use of worksheet. Your deduction is phased out if your magi is more than 189000 but less than 199000 if youre married and your spouse is covered by a retirement plan at work and you arent and if you live with your spouse or file a joint return.

If your modified agi is 199000 or more you cant take a deduction for contributions to a traditional ira. More than 181000 but less than 191000. Ira deduction worksheet form 1040 instructions html.

You can figure your individual retirement account deduction on the ira deduction worksheet in the internal revenue service instructions for form 1040 the individual tax return. Individual retirement arrangement ira worksheet. Examples worksheet for reduced ira deduction for 2014.

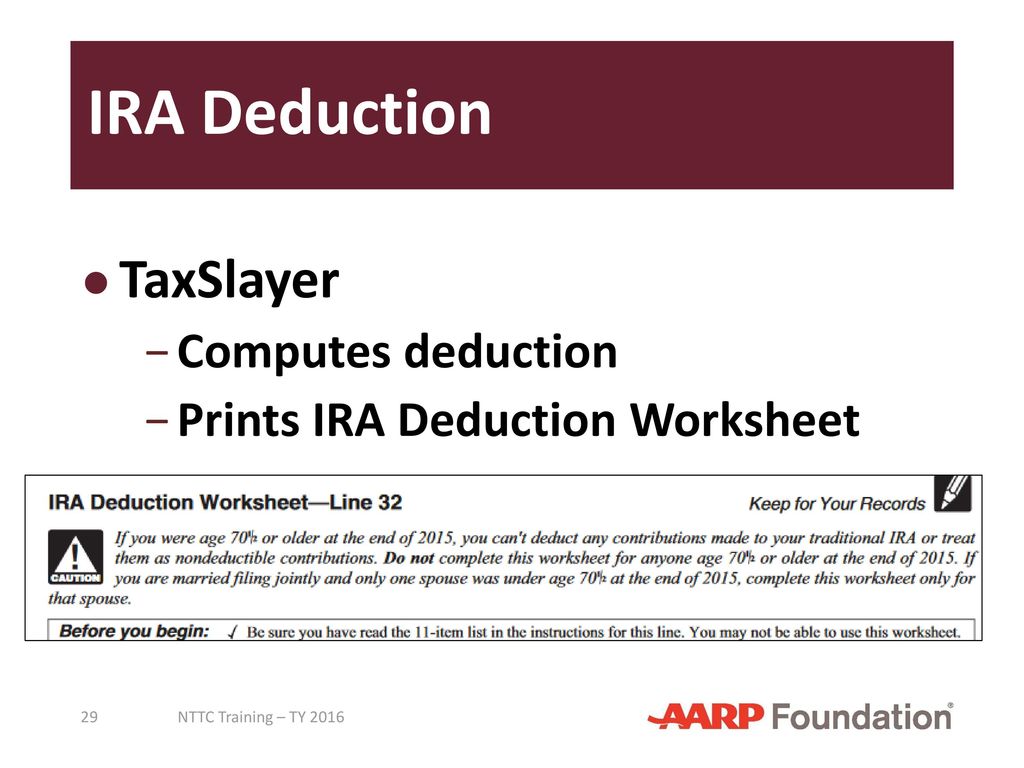

Married filing jointly with a spouse who is covered by a plan at work. 2014 form 1040line 32 ira deduction worksheetline 32 keep for your records a if you were age 701 or older at the end of 2014 you cannot deduct any contributions made to your traditional rd or treat them as nondednclibie contributionsdo not complete this worksheet for anyone age 7013 or older at the end of c aution 2014. Dont complete this worksheet for anyone age 70 1 2 or older at the end of 2017.

2014 ira deduction worksheet. An individual retirement annuity must meet all the following requirements. 2013 ira deduction worksheet.

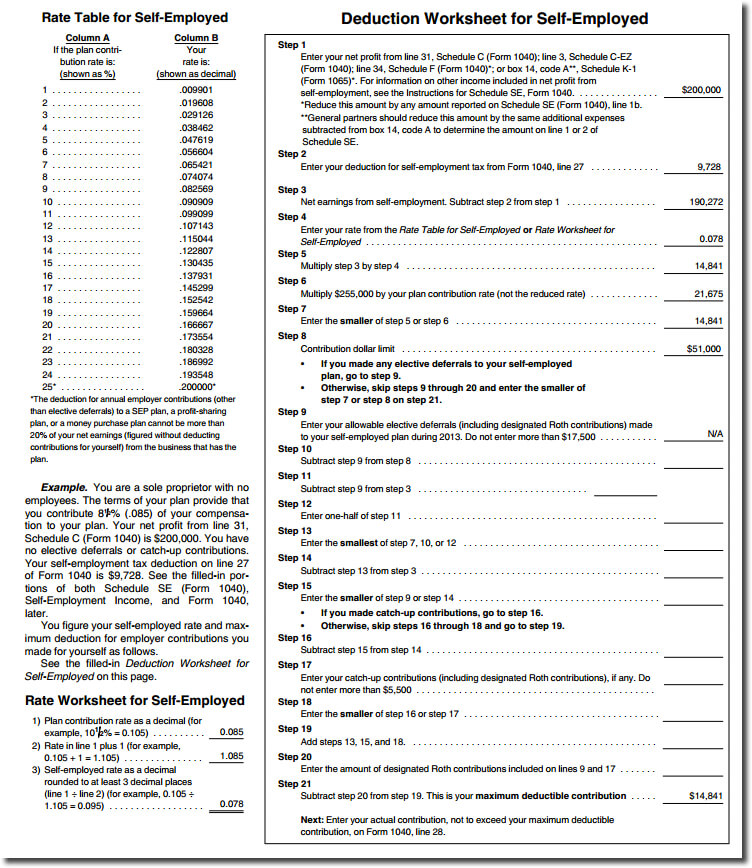

A full deduction up to the amount of your contribution limit. 50000 from schedule c c ez or k 1 step 2deduction for self employment tax 2. The instructions for form 1040 and form 1040nr include similar worksheets that you can use instead of the worksheet in this publication.

Sep ira contribution worksheet 2017 example yourself step 1net business profits 1. The amount you can deduct depends on your contributions your age your income and the type of ira you use. You can figure your reduced ira deduction by using worksheet 1 2.

Ira deduction worksheet form 1040 instructions html. Ira deduction worksheet form 1040 instructions page 34. Ira deduction worksheetline 32 keep for your records if you were age 70 1 2 or older at the end of 2017 you cant deduct any contributions made to your traditional ira or treat them as nondeductible contributions.

Student Loan Interest Deduction Worksheet Yooob Org

Student Loan Interest Deduction Worksheet Yooob Org

Standard Deduction Worksheet Oaklandeffect

Ira Deduction Worksheet Counting Money Worksheets Punctuation

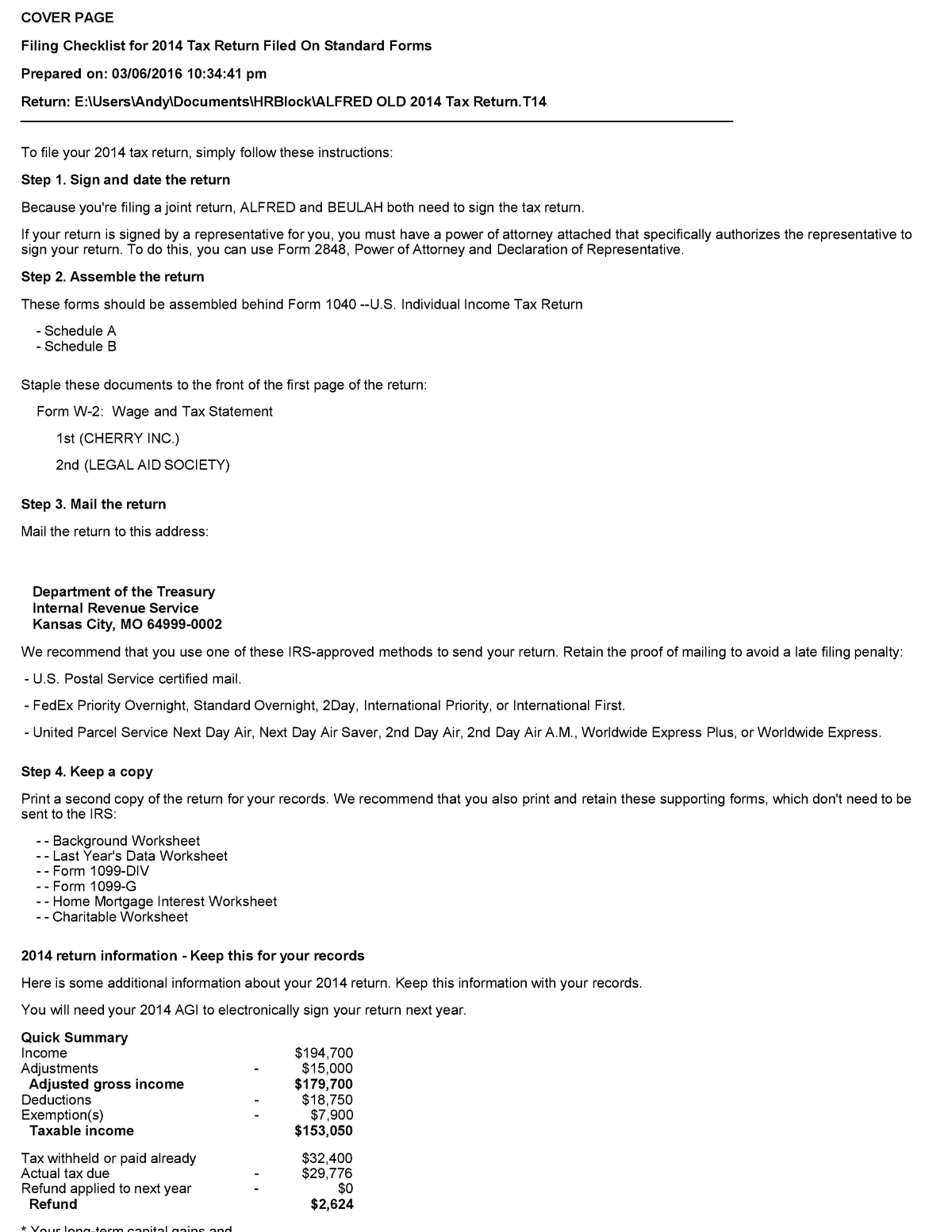

2014 1040 Old Alfred E Beulah A Acc 321 Tax Accounting I Studocu

2014 1040 Old Alfred E Beulah A Acc 321 Tax Accounting I Studocu

Publication 590 B 2018 Distributions From Individual Retirement

Publication 590 B 2018 Distributions From Individual Retirement

Late Contributions To The Backdoor Roth Ira The White Coat

Late Contributions To The Backdoor Roth Ira The White Coat

2014 Instructions For Schedule A Form 1040 Pdf

2014 Instructions For Schedule A Form 1040 Pdf

Adjustments To Income Pub 4491 Lesson 18 Pub 4012 Tab E Ppt

Adjustments To Income Pub 4491 Lesson 18 Pub 4012 Tab E Ppt

Itemized Fee Worksheet Excel New Itemized Deduction Worksheet Unique

Itemized Fee Worksheet Excel New Itemized Deduction Worksheet Unique

Ira Deduction Worksheet 2016 New 26 Unique The Debt Snowball

Ira Deduction Worksheet 2016 New 26 Unique The Debt Snowball

Home Business Tax Deductions Worksheet 2014 Premier

Home Business Tax Deductions Worksheet 2014 Premier

When Should You Consider A Sep Ira Wealthfront Knowledge Center

When Should You Consider A Sep Ira Wealthfront Knowledge Center

1040 Line 32 Instructions Pocketsense

1040 Line 32 Instructions Pocketsense

Clothing Deduction Worksheet 650 790 Ira Deduction Worksheet

2014 Child Tax Credit Worksheet 2014 Form Imoline 52 2014 Child

2014 Child Tax Credit Worksheet 2014 Form Imoline 52 2014 Child

St14 07 Ira Non Deductible Contributions And Distributions Pdf

St14 07 Ira Non Deductible Contributions And Distributions Pdf

Use Excel To File Your 2014 Form 1040 And Related Schedules

Use Excel To File Your 2014 Form 1040 And Related Schedules

Make Backdoor Roth Easy On Your Tax Return

Make Backdoor Roth Easy On Your Tax Return

Our Instructor For The Two Day Seminar Michael Miranda

There Is Still Time To Make Your Ira Contribution For The 2014 Tax

Itemized Deductions Worksheet The Best Worksheets Image Collection

Ira Deduction Worksheet Counting Money Worksheets Punctuation

Home Based Business Tax Deductions Worksheet

United States Ira Deduction Worksheet Question 6 Married Filing

United States Ira Deduction Worksheet Question 6 Married Filing

2014 1040 Cole David Ella Acc 321 Tax Accounting I Studocu

2014 1040 Cole David Ella Acc 321 Tax Accounting I Studocu

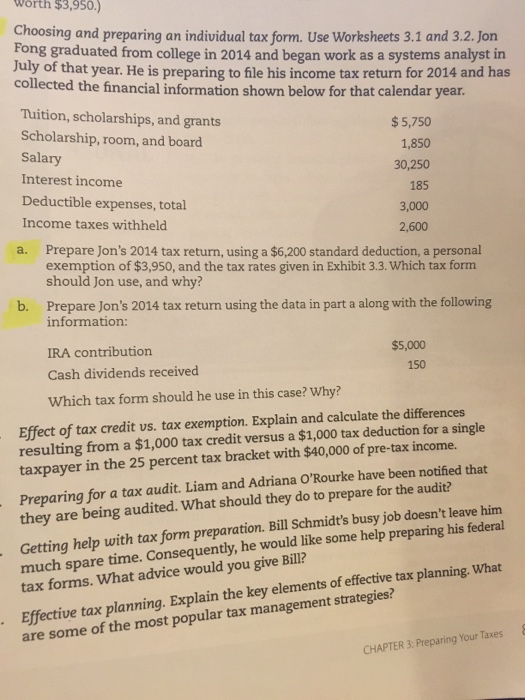

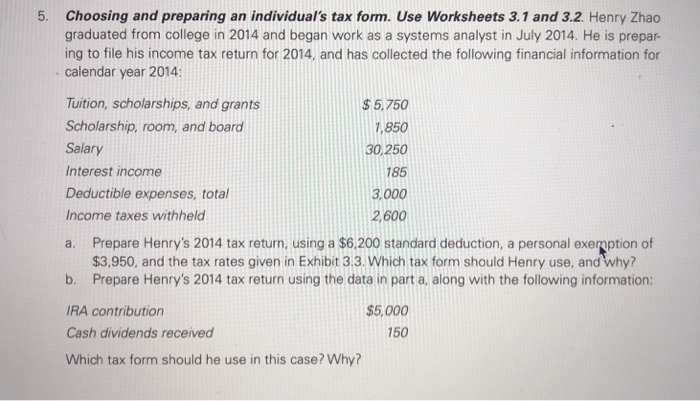

Solved Choosing And Preparing An Individual S Tax Form U

Solved Choosing And Preparing An Individual S Tax Form U

0 Response to "Ira Deduction Worksheet 2014"

Post a Comment