Nol Calculation Worksheet Excel

Generally when there is a nol at the end of the year then you have to carryback the whole nol to the two tax years before the nol year carryback period. How to use an nol once the nol has been calculated for the year it is used to offset.

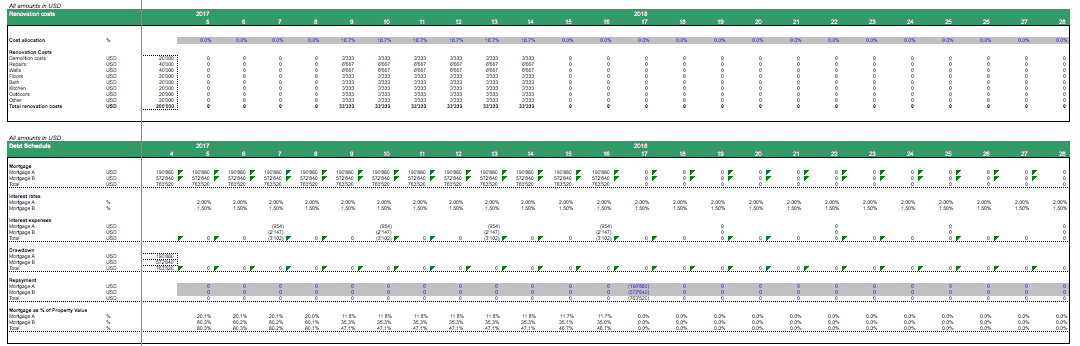

The Ultimate Guide To Financial Modeling Best Practices Wall

The Ultimate Guide To Financial Modeling Best Practices Wall

The taxslayer pro story.

Nol calculation worksheet excel. Irs form 4797 sales of business property is not included on this worksheet due to its infrequent use. So this loss should no longer be carried over. Your taxable income for 2018 is 5000 without your 9000 nol deduction.

This figure represents the amt nol for the current year. Net operating loss worksheet form 1045. The tuition and fees deduction.

I would still have 10 of unused loss to carry forward however i am only able to carry the loss from year 1 through year 20. If none of these items apply to you enter zero on line 6. If rgs is used for the computation instead of entering the item 15 reference number information on the form 5403 worksheet the tcs or ao may print either the rgs form 5403 or the rgs form 5344 if these forms have the correct item 15 information and attach one of them to the form 5403 worksheet.

We offer a professional tax package for tax preparers across the united states with all the forms and features to prepare and electronically file tax returns for clients. Taxslayer pro grew out of a family owned company with 50 years in the tax preparation business. When claiming on form 6251 the deductible amount is limited to 90 of the amt income.

The current calculation would show my taxable income in year 21 to be 40. P7 the student loan interest deduction. Then if there is any leftover nol after the carryback period you carryforward the balance for up to 20 years after the nol year.

If applicable a lender may include analysis of the sale and related recurring capital gains. Is there a spreadsheet to assist in calculating nol carryforward schedule a and where can i find it. Im probably not explaining that very good.

However it should really be 50. Is there a spreadsheet to assist in calculating nol carryforward is there a spreadsheet to. Your nol carryover to 2019 is the total of the amount on line 10 of the worksheet and all later nol amounts.

Schedule a form 1045 can still be used as a worksheet to calculate the nol even if form 1045 is not filedto carry the nol back or the tax payer elects to carryforward the nol. Otherwise increase your adjusted gross income by the total of lines 3 through 5 and your nol deduction for the nol year entered at the top of the worksheet and later years. The nol year use form 1040x to carryback the nol.

Examples of amt business income and business deductions these items are automatically included in the taxable income amount on line 1 of the worksheet.

Nol Worksheet Karenlynndixon Info

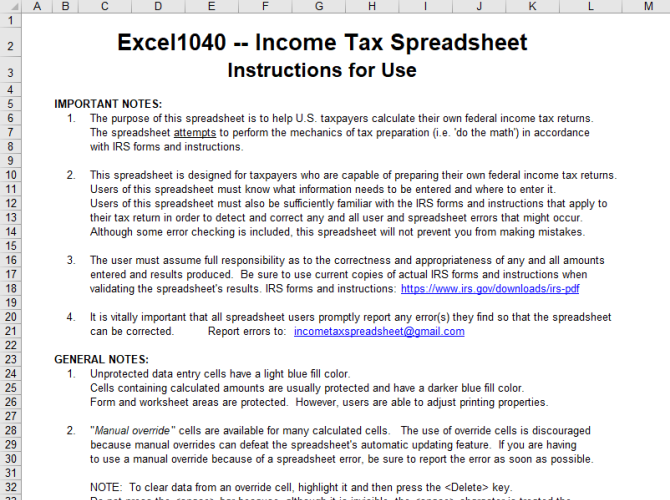

Turn Microsoft Excel Into A Tax Calculator With These Templates

Turn Microsoft Excel Into A Tax Calculator With These Templates

Publication 5292 2017 How To Calculate Section 965 Amounts And

Publication 5292 2017 How To Calculate Section 965 Amounts And

A Complete Guide On Net Operating Loss Wallstreetmojo

A Complete Guide On Net Operating Loss Wallstreetmojo

Nol Worksheet Karenlynndixon Info

Publication 5292 2017 How To Calculate Section 965 Amounts And

Publication 5292 2017 How To Calculate Section 965 Amounts And

How To Calculate The Net Operating Loss Carryover Chron Com

How To Calculate The Net Operating Loss Carryover Chron Com

Publication 5292 2017 How To Calculate Section 965 Amounts And

Publication 5292 2017 How To Calculate Section 965 Amounts And

How To Embed Tables Spreadsheet Data In Web Pages

How To Use Excel To File Form 1040 And Related Schedules For 2017

How To Use Excel To File Form 1040 And Related Schedules For 2017

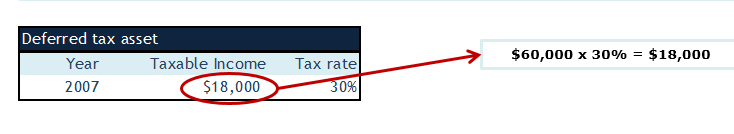

Chapter 6 Solutions Managerial Accounting 15th Edition Chegg Com

Chapter 6 Solutions Managerial Accounting 15th Edition Chegg Com

Publication 5292 2017 How To Calculate Section 965 Amounts And

Publication 5292 2017 How To Calculate Section 965 Amounts And

Nol Worksheet Karenlynndixon Info

Nol Worksheet Karenlynndixon Info

Tax Loss Carry Forward Nol Tax Loss Carry Forward

Publication 5292 2017 How To Calculate Section 965 Amounts And

Publication 5292 2017 How To Calculate Section 965 Amounts And

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Tax Loss Carry Forward Nol Tax Loss Carry Forward

Get Live Data From Web Pages Into Excel Spreadsheets With Web Queries

Get Live Data From Web Pages Into Excel Spreadsheets With Web Queries

A Complete Guide On Net Operating Loss Wallstreetmojo

A Complete Guide On Net Operating Loss Wallstreetmojo

National Association Of Tax Professionals

Tax Loss Carry Forward Excel Tax Loss Carry Forward

Tax Loss Carry Forward Excel Tax Loss Carry Forward

Tax Loss Carry Forward Excel Tax Loss Carry Forward

Tax Loss Carry Forward Excel Tax Loss Carry Forward

How To Use Excel To File Form 1040 And Related Schedules For 2017

How To Use Excel To File Form 1040 And Related Schedules For 2017

Mathematics 1202 Overtime Worksheet Answers Edit Fill Print

Mathematics 1202 Overtime Worksheet Answers Edit Fill Print

Nol Worksheet Karenlynndixon Info

Nol Worksheet Karenlynndixon Info

The Most Useful Microsoft Excel Formulas For Accountants

The Most Useful Microsoft Excel Formulas For Accountants

The Ultimate Guide To Financial Modeling Best Practices Wall

The Ultimate Guide To Financial Modeling Best Practices Wall

8 17 5 Special Computation Formats Forms And Worksheets Internal

8 17 5 Special Computation Formats Forms And Worksheets Internal

Net Loss On Income Statement Examples Formula Calculate Net Losses

Net Loss On Income Statement Examples Formula Calculate Net Losses

Nol Worksheet Karenlynndixon Info

0 Response to "Nol Calculation Worksheet Excel"

Post a Comment