Section 125 Nondiscrimination Testing Worksheet

For sponsors of section 125 premium only plans andor health reimbursement arrangements to conduct non discrimination testing is not required until the end of the plan year but it is usually a good idea for employers to conduct a sample test mid yearthat leaves time to adjust anything that might be starting to head in the wrong direction. Section 125 nondiscrimination test to retain its tax advantages a cafeteria plan must pass certain tests to ensure that it does not discriminate in favor of certain highly compensated or key employees.

Fx 4251 101409 Make The Most Of Your Fsa Program Indd

Nondiscrimination testing general information.

Section 125 nondiscrimination testing worksheet. This saves both the employer and the employee money on income taxes and social security taxes. If a cafeteria plan fails to pass nondiscrimination testing. Nondiscrimination testing guide.

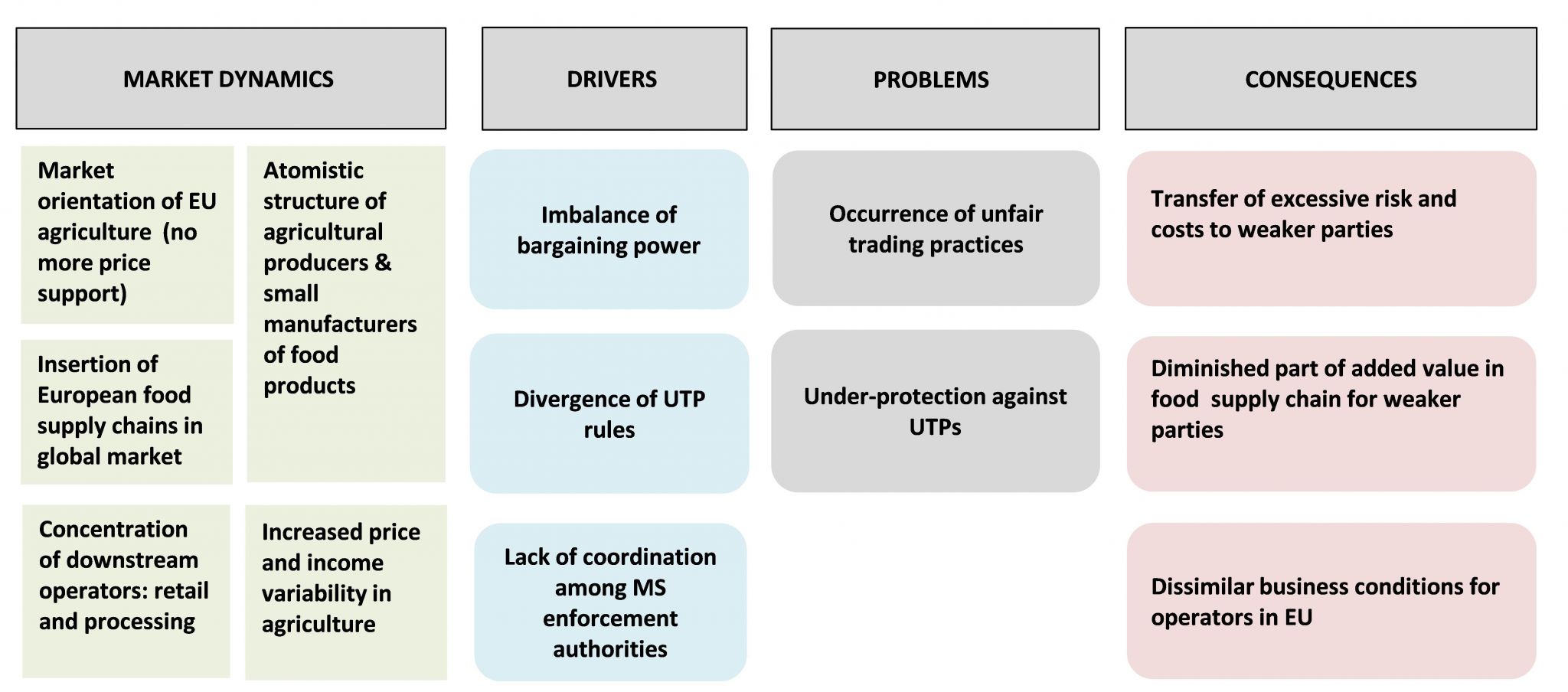

This means any plans that allow employees to contribute pre tax income into a benefits account such as a flexible spending account fsa. What types of section 125 non discrimination testing are availablecafeteria plan testing25 key employee concentration test ensures of all the pre tax dollars being spent through the cafeteria plan no more than 25 is being spent by key employeeseligibility test ensures enough non highly compensated employees are eligible to participate in the cafeteria planfsa health. Those rules prohibit a cafeteria plan from discriminating in favor of highly.

The three questions to ask to determine non discrimination for the cafeteria plan are. The irs requires non discrimination testing for employers who offer plans governed by section 125. Summary of group health plan non discrimination testing cypress benefit administrators march 2015 cafeteria plan testing a cafeteria plan section 125 plan is subject to certain nondiscrimination rules under internal revenue code irc section 125.

In order to qualify for tax favored status a benefit plan must not discriminate in favor of highly compensated employees hces and key employees with respect to eligibility contributions or benefits. Section 125 plan nondiscrimination requirements testing early february 11 2018 diane cross some employers are beginning to receive section 125 nondiscrimination testing requests from their third party administrators and for some this is just weeks after the start of the plan year. Section 125 nondiscrimination testing what is section 125 nondiscrimination testing.

2017 section 125 discrimination worksheet 25 key employee calculation test 1. Your plan allows employees to pay for their health care and dependent care expenses on a pretax basis. Can enough non hceskeys get into the plan.

Under the 2007 proposed regulations code section 125 nondiscrimination tests are to be performed as of the last day of the plan year taking into account all non excludable employees who were employed on any day during the plan year.

401 K Adp Test Why Your Employees Actual Deferral Percentage Matters

401 K Adp Test Why Your Employees Actual Deferral Percentage Matters

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Section 125 Plan Administration American Fidelity

Section 125 Plan Administration American Fidelity

Section 125 Plan Administration American Fidelity

Section 125 Plan Administration American Fidelity

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Hsa Fsa Hra Professional Benefit Services Third Party

Hsa Fsa Hra Professional Benefit Services Third Party

Employer Hsa Contribution Comparability Or Nondiscrimination Rules

Employer Hsa Contribution Comparability Or Nondiscrimination Rules

Key Points Nondiscrimination Testing Irs Requirements What Is

Key Points Nondiscrimination Testing Irs Requirements What Is

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Retirement Plan Administration Mercer Hr Services Service 401 K

Retirement Plan Administration Mercer Hr Services Service 401 K

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Tennessee Housing Development Agency Board Of Directors November 13

Designing And Managing Flexible Benefits Cafeteria Plans

Designing And Managing Flexible Benefits Cafeteria Plans

Nondiscrimination Rules For Cafeteria Plans Updated

Nondiscrimination Rules For Cafeteria Plans Updated

Publication 560 2018 Retirement Plans For Small Business

Publication 560 2018 Retirement Plans For Small Business

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Section 125 Nondiscrimination Testing Worksheet Briefencounters

Fx 4251 101409 Make The Most Of Your Fsa Program Indd

Fx 4251 101409 Make The Most Of Your Fsa Program Indd

Premium Only Plan Pop Safe Harbor Test For Eligibility Flexible

Premium Only Plan Pop Safe Harbor Test For Eligibility Flexible

How To Identify Key Employees And Hces To Conduct Non Discrimination

How To Identify Key Employees And Hces To Conduct Non Discrimination

Fsa Plan Nondiscrimination Testing Worksheet Fill Online

Fsa Plan Nondiscrimination Testing Worksheet Fill Online

Answers Spoken Here Bestflex Plan Premium Only Answer Book

Section 125 Cafeteria Plan Employer Guide

Employer Administered Flexible Spending Account Pdf

Employer Administered Flexible Spending Account Pdf

0 Response to "Section 125 Nondiscrimination Testing Worksheet"

Post a Comment