Worksheet For Figuring Net Earnings Loss From Self Employment

You can change the method used to figure your net earnings from self employment after you file your return. If negative enter in the gross income if loss field.

How To Pay Self Employment Tax With Pictures Wikihow

How To Pay Self Employment Tax With Pictures Wikihow

To calculate your plan compensation you reduce your net earnings from self employment by.

Worksheet for figuring net earnings loss from self employment. Do not complete this line for any partner that is an estate trust corporation exempt organization or individual retirement arrangement ira. Self employment earnings loss line 14a net earnings loss from self employment amounts reported in box 14 code a represent the amount of net earnings from self employment. Comments about tax map.

For limited partners this amount generally includes any guaranteed payments received for services rendered to or on behalf of the partnership. Net profit or loss add. You may find worksheets 1 through 3 helpful in figuring your net earnings from self employment.

Instructions for schedule se form 1040. Net earnings loss from self employment schedule k. Enter on line 14a the amount from line 5 of the worksheet.

The deductible portion of your se tax from your form 1040 return page 1 and the amount of your own not your employees retirement plan contribution from your form 1040 return page 1 on the line for self employed sep simple and qualified plans. Net operating losses from other years. Blank worksheets are in the back of this publication.

Add any part of the amount for contract labor that. To calculate income from schedule c profit or loss from business. Under this method figure your net earnings from self employment by totaling your gross income for services you performed as a minister a member of a religious order who hasnt taken a vow of.

Line h if the tax return does not include a full year of self employment earnings then the. That is you can change from the regular to the optional method or from the optional to the. F 16036 self employment income worksheet partnership schedule k 1065 sei taxes income.

Self employment income worksheet. Enter in the gross income field on the self employment page in cww. Other net rental income or loss.

Instructions For Schedule Se Form 1040 2017 Printable Pdf Download

Instructions For Schedule Se Form 1040 2017 Printable Pdf Download

How To Pay Self Employment Tax With Pictures Wikihow

How To Pay Self Employment Tax With Pictures Wikihow

Self Employment Tax Everything You Need To Know Smartasset

Self Employment Tax Everything You Need To Know Smartasset

Tips On Proving Income When Self Employed Chron Com

Tips On Proving Income When Self Employed Chron Com

Publication 596 2018 Earned Income Credit Eic Internal

Publication 596 2018 Earned Income Credit Eic Internal

:max_bytes(150000):strip_icc()/486989103-profit-loss-56a0a4153df78cafdaa386db.jpg) Net Earnings Calculation For Business Taxes

Net Earnings Calculation For Business Taxes

:brightness(10):contrast(5):no_upscale()/woman-hand-working-with-calculator--business-document-and-laptop-computer-notebook--698971302-5b3556bc46e0fb0054ab9161.jpg) Deductions And Adjusted Gross Income On Your Tax Return

Deductions And Adjusted Gross Income On Your Tax Return

Publication 974 2018 Premium Tax Credit Ptc Internal Revenue

Publication 974 2018 Premium Tax Credit Ptc Internal Revenue

How To Do A Profit And Loss Statement When You Re Self Employed

How To Do A Profit And Loss Statement When You Re Self Employed

Schedule Se Self Employment Faqs 1099m 1120s K1 Schedulec

Retained Earnings Formula Examples How To Calculate

Retained Earnings Formula Examples How To Calculate

Publication 505 2019 Tax Withholding And Estimated Tax Internal

Publication 505 2019 Tax Withholding And Estimated Tax Internal

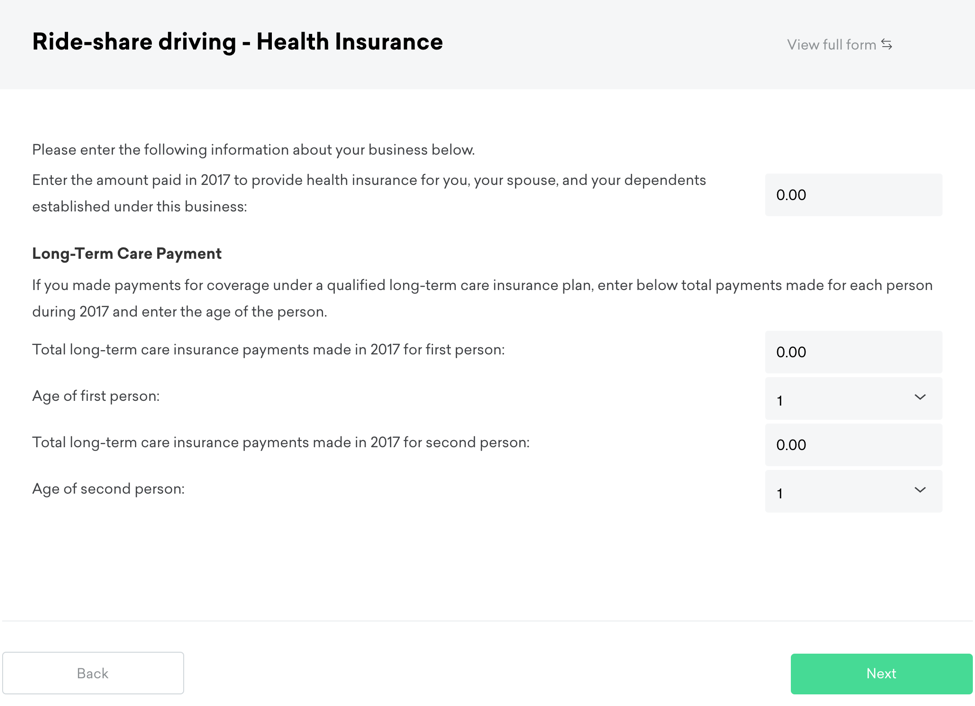

You Can Report 1099 Income Using Credit Karma Tax

You Can Report 1099 Income Using Credit Karma Tax

Credit Karma Guide To Self Employment Taxes Credit Karma

Credit Karma Guide To Self Employment Taxes Credit Karma

Schedule Se Self Employment Faqs 1099m 1120s K1 Schedulec

Completing Form 1040 The Face Of Your Tax Return Us Expat Taxes

Completing Form 1040 The Face Of Your Tax Return Us Expat Taxes

:max_bytes(150000):strip_icc()/GettyImages-614263348-5c3362f3c9e77c0001acf690.jpg) Net Earnings Calculation For Business Taxes

Net Earnings Calculation For Business Taxes

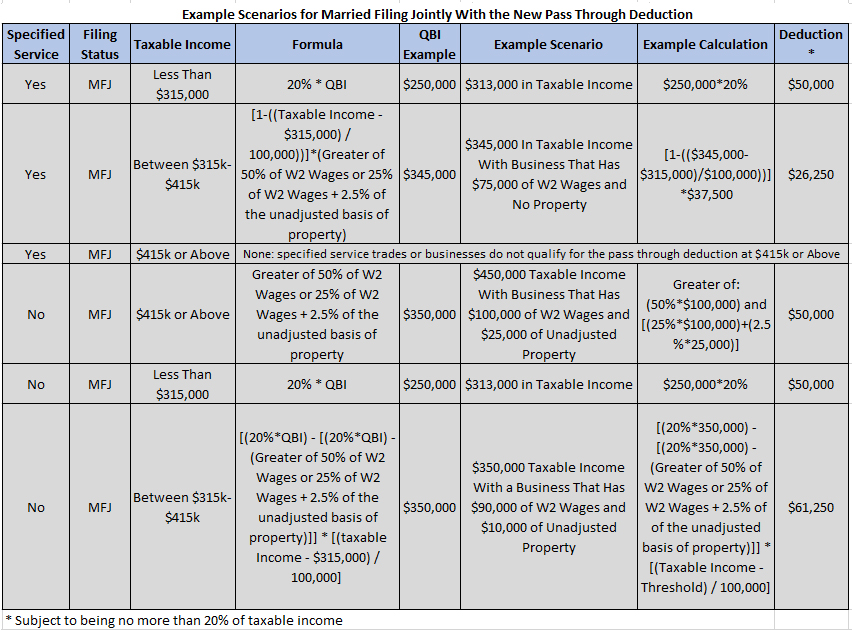

The Pass Through Tax Deduction Explained With Calculation Examples

The Pass Through Tax Deduction Explained With Calculation Examples

How To Read A W 2 Earnings Summary Credit Karma

How To Read A W 2 Earnings Summary Credit Karma

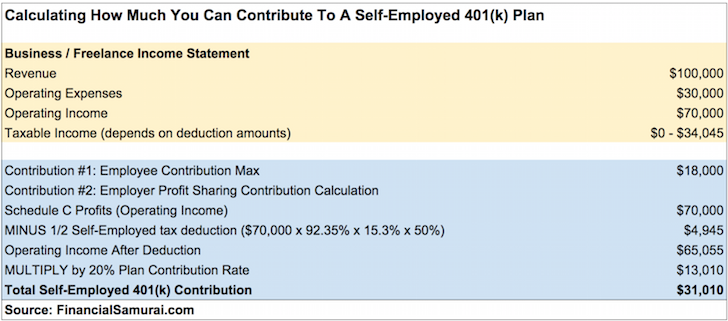

How Much Can I Contribute To My Self Employed 401 K Plan

How Much Can I Contribute To My Self Employed 401 K Plan

Publication 590 A 2018 Contributions To Individual Retirement

Publication 590 A 2018 Contributions To Individual Retirement

Qbi Deduction Frequently Asked Questions Qbi Schedulec

Qbi Deduction Frequently Asked Questions Qbi Schedulec

0 Response to "Worksheet For Figuring Net Earnings Loss From Self Employment"

Post a Comment